The Importance of Emergency Funds and How to Build One

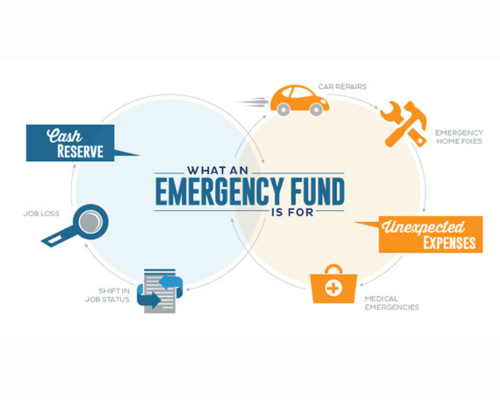

An emergency fund is a crucial component of a sound financial plan, providing a safety net that can help you navigate unexpected expenses or financial setbacks without derailing your long-term goals. Whether you're dealing with sudden medical bills, car repairs, job loss, or other unforeseen circumstances, having an emergency fund can offer peace of mind and financial stability. In this blog post, we'll explore the importance of emergency funds and provide practical steps for building one.

Why Emergency Funds Are Essential

- Financial Security

- Stress Reduction

- Prevents Disruption to Financial Goals

- Avoiding Liquidation of Investments

How Much Should You Save?

The amount to save in an emergency fund depends on your personal circumstances, such as your income, expenses, and financial responsibilities. A common recommendation is to have three to six months' worth of living expenses saved. However, the appropriate amount can vary:- Single Income Households: If your household relies on a single income, it's wise to save closer to six months of expenses, as losing this income could have a significant impact.

- Dual Income Households: In a household with multiple incomes, three months of expenses might suffice, provided both incomes are relatively stable.

- Self-Employed or Irregular Income: For those with variable income or self-employment, it may be prudent to save even more, perhaps six to twelve months of expenses, to account for potential fluctuations in income.

Steps to Build an Emergency Fund

- Set a Savings Goal

- Start Small and Build Gradually

- Automate Your Savings

- Cut Unnecessary Expenses

- Use Windfalls Wisely

- Keep Your Fund Accessible but Separate

- Reevaluate and Adjust

- Prioritize and Protect

Conclusion

An emergency fund is a fundamental part of financial planning, providing a vital buffer against life's unexpected challenges. By understanding the importance of an emergency fund and taking steps to build and maintain one, you can enhance your financial security and peace of mind. Start small, be consistent, and make saving a priority. With time and discipline, you'll be well-prepared to handle unexpected expenses and protect your long-term financial health.All Categories

Recent Posts

guardianpolicies0 Comments

Preparing for Retirement Essential Financial Steps to Take in Your 40s and 50s

guardianpolicies0 Comments

The Impact of Credit Scores on Insurance Premiums What You Need to Know

guardianpolicies0 Comments