The Pros and Cons of Whole Life vs. Term Life Insurance

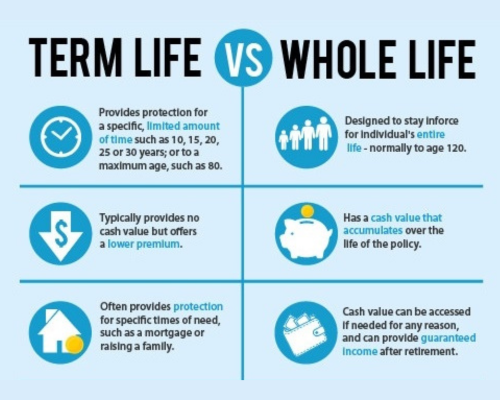

Choosing the right life insurance policy is a crucial financial decision that can have long-term implications for you and your family. Among the most common options are whole life and term life insurance. Each type has its unique features, benefits, and drawbacks, making it essential to understand how they differ to make an informed choice. This article explores the pros and cons of whole life and term life insurance, helping you decide which is best suited to your needs.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides lifelong coverage and includes a cash value component that grows over time.Pros of Whole Life Insurance:

- Lifelong Coverage: Whole life insurance covers you for your entire life, provided premiums are paid. This ensures that your beneficiaries will receive a death benefit regardless of when you pass away.

- Cash Value Accumulation: A portion of your premiums goes into a cash value account, which grows tax-deferred over time. This cash value can be borrowed against or withdrawn, providing a potential source of funds for emergencies or other financial needs.

- Fixed Premiums: Premiums for whole life policies are typically fixed, meaning they won't increase as you age. This can be beneficial for budgeting and long-term planning.

- Dividend Payments: Some whole life policies, known as participating policies, may pay dividends to policyholders, depending on the insurer's performance. These dividends can be taken in cash, used to reduce premiums, or reinvested to increase the policy's cash value and death benefit.

Cons of Whole Life Insurance:

- Higher Premiums: Whole life insurance generally has higher premiums compared to term life insurance. The added cost is due to the lifelong coverage and the cash value component.

- Complexity: The cash value aspect and potential dividend payments make whole life insurance more complex than term life policies. Understanding the details and managing the policy can require more time and effort.

- Lower Returns on Cash Value: The growth rate on the cash value component is typically lower than what you might achieve with other investment vehicles. This can make whole life insurance less attractive for those looking for higher investment returns.

- Surrender Charges: Withdrawing cash value or canceling the policy in the early years can result in surrender charges, which can significantly reduce the amount you receive.

Term Life Insurance

Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years, and pays a death benefit if the insured passes away during the term.Pros of Term Life Insurance:

- Affordability: Term life insurance generally offers lower premiums than whole life insurance, making it more affordable for many individuals, especially younger policyholders.

- Simplicity: Term policies are straightforward, offering a death benefit with no cash value component. This simplicity makes it easier to understand and manage.

- Flexibility: Term lengths can be chosen based on your needs, such as covering the period until children are financially independent or a mortgage is paid off. This flexibility allows you to tailor coverage to your specific situation.

- Convertible Options: Some term policies offer the option to convert to a whole life policy without undergoing a new medical exam. This can be beneficial if your needs change or if you want permanent coverage later on.

Cons of Term Life Insurance:

- Temporary Coverage: Coverage ends when the term expires, and if the insured does not renew or convert the policy, there is no death benefit paid. This can be a disadvantage if you still need coverage after the term ends.

- Premium Increases on Renewal: If you decide to renew your term policy after it expires, premiums can increase significantly based on your age and health status.

- No Cash Value: Unlike whole life insurance, term policies do not accumulate cash value. Once the term ends, you don't receive any payout or benefit from the premiums paid.

- No Savings Component: For those looking to combine life insurance with a savings or investment component, term life insurance may not meet those needs.

Conclusion

Choosing between whole life and term life insurance depends on your individual needs, financial goals, and budget. Whole life insurance offers lifelong coverage and a cash value component, making it suitable for those seeking permanent protection and a potential savings vehicle. However, its higher premiums and complexity may not be ideal for everyone. Term life insurance, with its affordability and simplicity, is a great option for those seeking temporary coverage or with budget constraints, but it lacks the cash value and permanent protection features. To determine the best option for you, consider factors such as your age, health, financial situation, and the specific needs of your beneficiaries. Consulting with a financial advisor or insurance professional can also provide valuable insights tailored to your circumstances.All Categories

Recent Posts

guardianpolicies0 Comments

Preparing for Retirement Essential Financial Steps to Take in Your 40s and 50s

guardianpolicies0 Comments

The Impact of Credit Scores on Insurance Premiums What You Need to Know

guardianpolicies0 Comments