Understanding the Different Types of Investment Vehicles: From Stocks to Bonds

Investing is a crucial part of financial planning, offering the potential to grow wealth and achieve long-term financial goals. However, navigating the myriad of investment options available can be overwhelming. This comprehensive guide explores the different types of investment vehicles, their benefits, risks, and how they fit into a diversified portfolio.

Different Types of Investment Vehicles

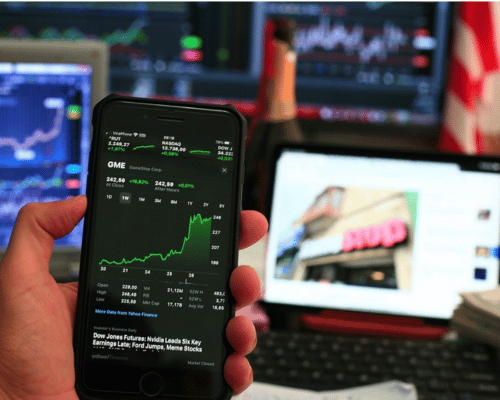

1. Stocks

Benefits:- Potential for High Returns: Stocks have historically provided higher returns compared to other asset classes over the long term.

- Liquidity: Stocks can be easily bought and sold on stock exchanges.

- Ownership: Investing in stocks gives you a share of ownership in a company, along with voting rights.

- Volatility: Stock prices can fluctuate widely in short periods.

- Market Risk: Economic downturns and market changes can negatively impact stock prices.

- Company Performance: Poor company performance can lead to losses.

- Growth: Stocks are ideal for investors seeking capital appreciation.

- Diversification: Including a variety of stocks can spread risk.

2. Bonds

Benefits:- Stability: Bonds are generally less volatile than stocks.

- Regular Income: Bonds provide regular interest payments.

- Capital Preservation: Bonds can help preserve capital, especially government and high-quality corporate bonds.

- Interest Rate Risk: Rising interest rates can decrease the value of existing bonds.

- Credit Risk: Issuer’s financial health can affect bond payments.

- Inflation Risk: Inflation can erode the purchasing power of bond returns.

- Income: Bonds are suitable for generating steady income.

- Diversification: They provide a counterbalance to the volatility of stocks.

- Safety: High-quality bonds add stability to a portfolio.

3. Mutual Funds

Benefits:- Diversification: Mutual funds invest in a mix of assets, spreading risk.

- Professional Management: Managed by experienced fund managers.

- Accessibility: Suitable for investors with limited capital.

- Management Fees: Can reduce overall returns.

- Market Risk: The value of the fund can fluctuate with the market.

- Performance Risk: Fund performance can vary based on management and market conditions.

- Diversified Exposure: Provides exposure to a broad range of assets.

- Convenience: Simplifies the investment process for individual investors.

4. Exchange-Traded Funds (ETFs)

Benefits:- Flexibility: Traded like stocks on an exchange.

- Lower Fees: Generally have lower expense ratios than mutual funds.

- Diversification: Can track a wide array of indices and sectors.

- Market Risk: Subject to market volatility.

- Tracking Error: May not perfectly track the underlying index.

- Liquidity Risk: Some ETFs may have low trading volumes.

- Cost-Effective Diversification: Provides diversified exposure at a lower cost.

- Tactical Allocation: Can be used for specific market segments.

5. Real Estate

Benefits:- Tangible Asset: Provides physical ownership and utility.

- Income Generation: Rental properties can generate regular income.

- Appreciation: Potential for property value to increase over time.

- Illiquidity: Real estate is not easily sold.

- Market Fluctuations: Property values can fluctuate based on market conditions.

- Maintenance Costs: Ongoing costs can impact returns.

- Diversification: Adds a non-correlated asset to a portfolio.

- Inflation Hedge: Property values and rents tend to rise with inflation.

6. Commodities

Benefits:- Diversification: Often move differently compared to stocks and bonds.

- Inflation Protection: Commodity prices tend to rise with inflation.

- Global Demand: Driven by global economic trends.

- Volatility: Commodity prices can be very volatile.

- No Income: Commodities do not generate income.

- Storage and Insurance Costs: Physical commodities have additional costs.

- Hedge Against Inflation: Protects against inflationary pressures.

- Diversification: Adds a non-traditional asset class.

7. Cryptocurrencies

Benefits:- High Growth Potential: Can offer substantial returns.

- Decentralization: Not controlled by any single entity.

- Innovation: Represents a new frontier in digital finance.

- Extreme Volatility: Prices can fluctuate widely.

- Regulatory Risk: Subject to regulatory changes and uncertainty.

- Security Risks: Susceptible to hacking and fraud.

- Speculative Growth: Suitable for risk-tolerant investors.

- Diversification: Provides exposure to a new asset class.

Building a Diversified Portfolio

Creating a diversified portfolio involves spreading investments across different asset classes to manage risk and maximize returns. Here are some key strategies:- Asset Allocation: Determine the right mix of asset classes based on your risk tolerance, investment goals, and time horizon.

- Rebalancing: Regularly review and adjust your portfolio to maintain your desired asset allocation.

- Research and Due Diligence: Stay informed about market conditions and the performance of your investments.

- Professional Advice: Consider consulting a financial advisor to tailor a portfolio that meets your individual needs.

Conclusion

Understanding the different types of investment vehicles is crucial for making informed decisions and building a robust investment portfolio. By balancing the benefits and risks of each investment type, you can create a diversified strategy that aligns with your financial goals and risk tolerance. Whether you're seeking growth, income, or stability, a well-diversified portfolio can help you navigate the complexities of the investment landscape and achieve long-term financial success.All Categories

Recent Posts

guardianpolicies0 Comments

Preparing for Retirement Essential Financial Steps to Take in Your 40s and 50s

guardianpolicies0 Comments

The Impact of Credit Scores on Insurance Premiums What You Need to Know

guardianpolicies0 Comments